Land transport

Previous | Table of contents | Next

2.3.1 Domestic, interstate and urban road freight

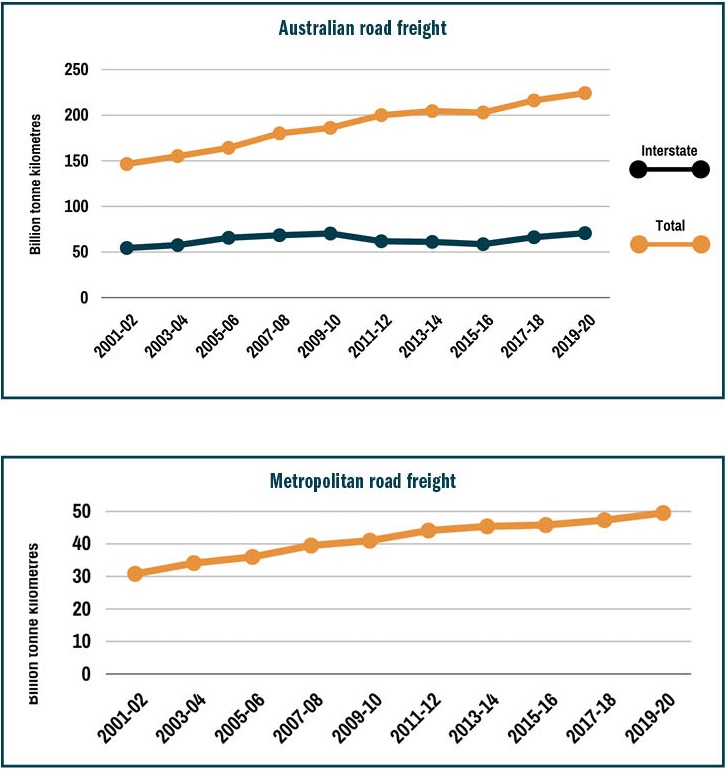

Road freight continues to grow, with interstate road freight continuing to represent close to one third of all road freight movements in Australia. Metropolitan road freight also shows no sign of slackening, and remains one of the fastest growing areas in the freight sector. Urban freight is forecast to grow by nearly 60% over 20 years to 2040.

| Online shopping and domestic resilience |

|---|

|

"Due to COVID-19, we've seen about ten years worth of trends in ten months - this is phenomenal!" —Paul Zahra, CEO, Australian Retailers Association It is well known that COVID-19 restrictions have added fuel to the rise of online shopping and eCommerce. In the 12 months to 30 June 2021, Victoria experienced the highest online shopping growth, up 48.9% year-on-year – well above the national average of 31.8%. The state also had the highest number of days in lockdown. As 2020-21 progressed, this trend appears likely to be sustained well into the long term. According to an Australia Post consumer survey in December 2020, respondents indicated they are shopping online 55% more than before the pandemic and, while they expect their online shopping frequency to decrease by about half as the health crisis abates, this will still be 28% higher than pre-COVID-19 levels. Another interesting aspect of the growth in eCommerce from COVID-19 is the international versus domestic sourcing dynamic. As mentioned elsewhere in this report, international transport of goods experienced severe delays due to shipping congestion, decline in airfreight and general disruption in supply chains. According to another Australia Post consumer survey, 52% of Australian online shoppers stated that delivery from overseas was taking far too long and that 57% of shoppers stated they wanted to support local businesses. Looking forward, a global survey found that 67% of participants agree that, ‘In future, I will buy more online from e-retailers based in my country’. It is expected this local focus will help build resilience. |

2.3.2 A third peak hour?

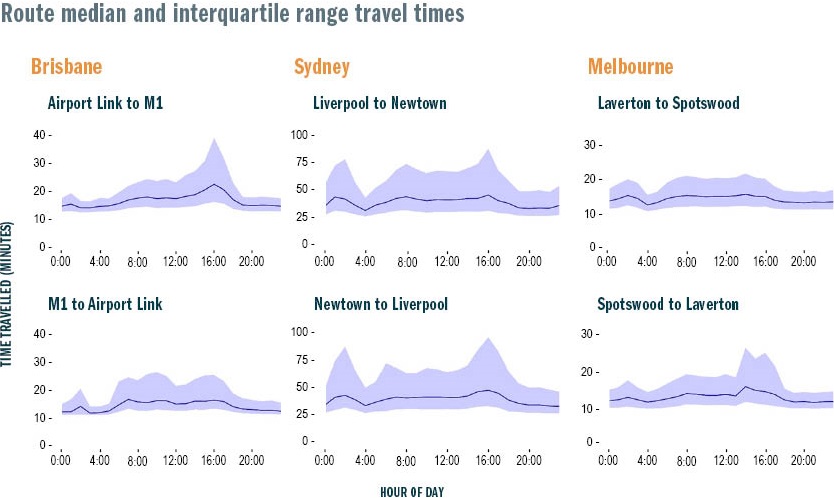

The Bureau of Infrastructure and Transport Research Economics will soon release the first of a new annual series of reports using vehicle telematics data to measure traffic congestion for freight vehicles. The first report looks at 53 selected routes across Australia’s five mainland state capital cities—Sydney, Melbourne, Brisbane, Adelaide and Perth – and covers the calendar year 2019.

Unsurprisingly, the paper finds that peaks in average travel time are usually at times of high commuter flows, towards city centres in the morning peak from 7 to 9 in the morning, and away from them from 3 to 6 in the afternoon. Interestingly though, a number of routes in all cities exhibited a ‘third’ travel time peak, between midnight and 5am, unrelated to commuter traffic.

The routes where this was most obvious were on major arterial surface (non-motorway) roads. The reason for this third peak is unclear, although freight specific activity, construction and/or road works are potential reasons. It may be a function of interstate or regional travel times to meet market requirements, such as arrivals at produce markets.

In 2019-20, intermodal rail freight volumes on the interstate network were stable overall, with a slight increase on the Perth-Eastern State corridor and a slight decline on the Melbourne-Brisbane corridor.

2.3.3 Rail data

This report does not include an examination of rail freight performance as no consistent rail freight data providing a full picture of freight across Australia has been provided by industry since 2017.